Table of Contents

- Introduction

- What is a Noble Bank Checking Account?

- Benefits of a Noble Bank Checking Account

- Key Features of Noble Bank Checking Accounts

- How to Open a Noble Bank Checking Account

- Types of Checking Accounts Offered by Noble Bank

- Fees and Charges Associated with Noble Bank Checking Accounts

- Digital Banking Services for Noble Bank Checking Account Holders

- Security Measures to Protect Your Noble Bank Checking Account

- Customer Support and Assistance

- Conclusion

Introduction

Managing personal finances effectively is crucial in today's fast-paced world, and choosing the right checking account can make all the difference. Noble Bank offers a range of checking accounts tailored to meet the needs of individuals and businesses alike. Whether you're looking for convenience, security, or advanced features, Noble Bank's checking accounts are designed to provide a seamless banking experience. In this article, we will explore the various aspects of Noble Bank checking accounts, including their benefits, features, and how they can help you achieve your financial goals.

With the rise of digital banking, Noble Bank has positioned itself as a leader in providing innovative financial solutions. Their checking accounts are not just about storing money; they offer tools and services that empower customers to manage their funds efficiently. From mobile banking apps to robust security measures, Noble Bank ensures that its customers have access to cutting-edge technology while maintaining the highest standards of trust and reliability.

As we delve deeper into this guide, you'll discover why Noble Bank checking accounts stand out in the crowded banking industry. We will also discuss the steps to open an account, the types of accounts available, and the fees associated with them. By the end of this article, you'll have a comprehensive understanding of how Noble Bank checking accounts can enhance your financial journey.

Read also:Maligoshik Of Exploring The Origins Evolution And Influence Of A Cultural Icon

What is a Noble Bank Checking Account?

A Noble Bank checking account is a type of deposit account that allows individuals and businesses to manage their day-to-day financial transactions. It serves as a central hub for depositing income, paying bills, and making purchases. Unlike savings accounts, checking accounts are designed for frequent transactions, offering features such as check writing, debit card usage, and online banking.

Noble Bank checking accounts are known for their flexibility and accessibility. Customers can access their funds through various channels, including ATMs, bank branches, and digital platforms. The bank also provides tools to help account holders track their spending, set budgets, and monitor account activity in real-time. This level of transparency and control makes Noble Bank checking accounts an attractive option for those seeking convenience and reliability.

In addition to basic transactional features, Noble Bank offers specialized checking accounts tailored to specific customer needs. For example, students, seniors, and small business owners can choose accounts that cater to their unique financial requirements. These accounts often come with additional perks, such as waived fees, higher interest rates, or exclusive rewards programs.

Benefits of a Noble Bank Checking Account

One of the primary benefits of a Noble Bank checking account is its ease of use. Customers can perform a wide range of transactions without hassle, thanks to the bank's user-friendly platforms and 24/7 accessibility. Whether you're transferring funds, paying bills, or depositing checks, Noble Bank ensures that the process is smooth and efficient.

Another significant advantage is the security measures in place to protect account holders. Noble Bank employs state-of-the-art encryption technology and multi-factor authentication to safeguard customer data. Additionally, the bank offers fraud monitoring services and zero-liability protection for unauthorized transactions, giving customers peace of mind.

Moreover, Noble Bank checking accounts often come with rewards and incentives. For instance, customers may earn cashback on debit card purchases, receive discounts on banking fees, or participate in exclusive promotions. These perks not only enhance the banking experience but also help customers save money in the long run.

Read also:Shubhashree Sahu A Comprehensive Guide To Her Life Career And Achievements

Key Features of Noble Bank Checking Accounts

Mobile Banking App

The Noble Bank mobile banking app is a standout feature, allowing customers to manage their accounts on the go. With the app, users can check balances, transfer funds, deposit checks, and pay bills from their smartphones. The app also provides real-time notifications for account activity, ensuring that customers stay informed about their finances.

Free ATM Access

Noble Bank has an extensive network of ATMs, and account holders can access their funds without incurring fees. The bank also partners with other financial institutions to provide surcharge-free ATM withdrawals, making it convenient for customers to withdraw cash wherever they are.

Overdraft Protection

To prevent bounced checks and declined transactions, Noble Bank offers overdraft protection services. Customers can link their checking accounts to a savings account or credit line, ensuring that funds are available when needed. This feature is particularly useful for avoiding costly overdraft fees.

How to Open a Noble Bank Checking Account

Opening a Noble Bank checking account is a straightforward process that can be completed online or in person. To get started, visit the Noble Bank website and navigate to the "Open an Account" section. You will need to provide some basic information, such as your name, address, Social Security number, and employment details.

Once you've submitted your application, Noble Bank will verify your identity and review your financial history. This step ensures compliance with banking regulations and helps the bank assess your eligibility for specific account types. After approval, you will receive your account details and can begin using your checking account immediately.

For those who prefer in-person assistance, Noble Bank branches are staffed with knowledgeable representatives who can guide you through the account-opening process. They can also answer any questions you may have and help you choose the best account for your needs.

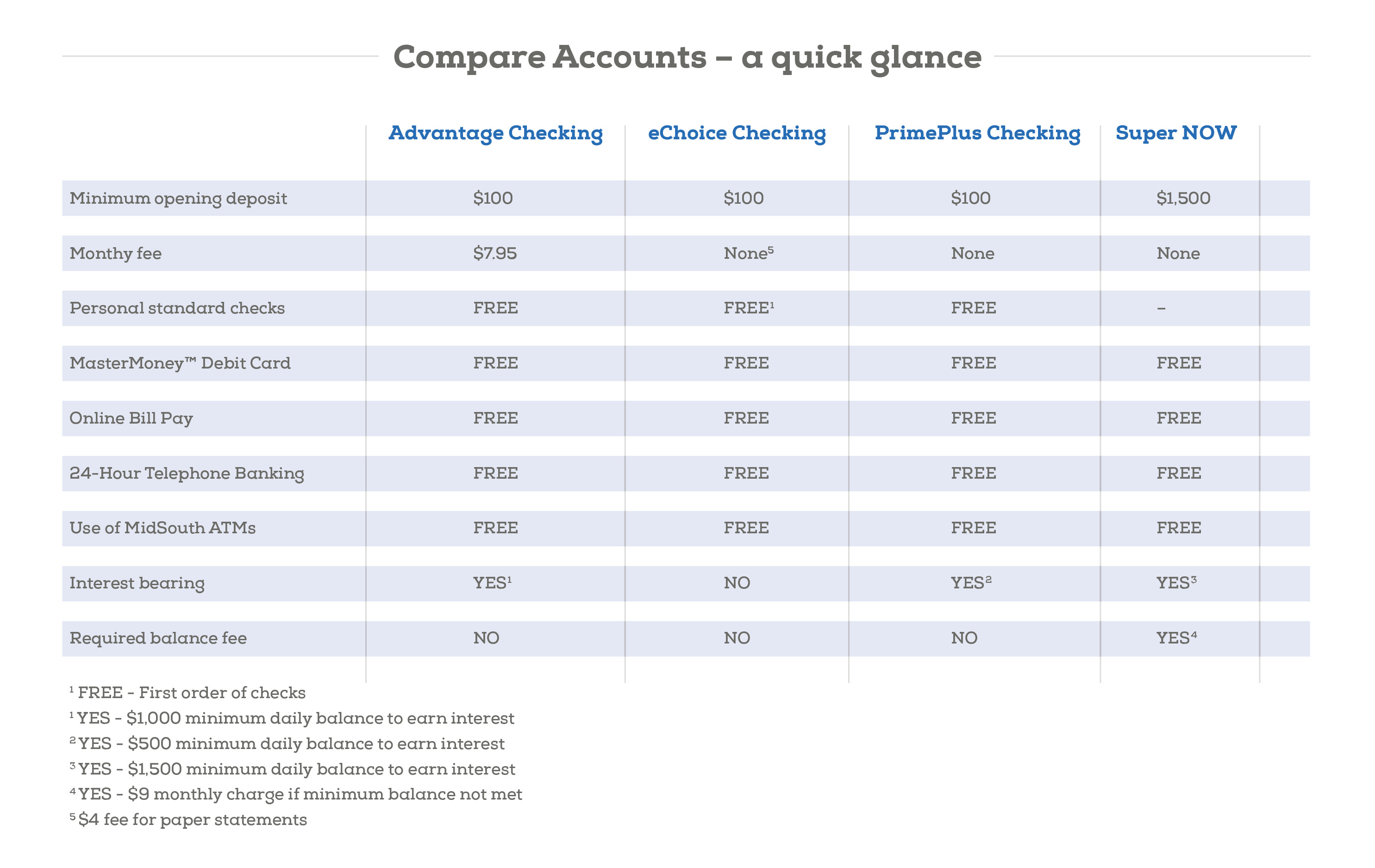

Types of Checking Accounts Offered by Noble Bank

Basic Checking Account

Ideal for individuals who want a no-frills banking experience, the Basic Checking Account offers essential features at a low cost. It includes check writing, debit card access, and online banking services.

Premium Checking Account

Designed for customers who require advanced features, the Premium Checking Account offers perks such as waived fees, higher interest rates, and exclusive rewards programs. This account is perfect for those who maintain a higher balance.

Student Checking Account

Tailored to meet the needs of students, this account offers benefits such as no monthly fees, free ATM access, and financial education resources. It's an excellent option for young adults who are just starting their financial journey.

Fees and Charges Associated with Noble Bank Checking Accounts

While Noble Bank strives to keep fees low, certain charges may apply depending on the type of account and services used. Common fees include monthly maintenance fees, overdraft fees, and ATM fees for out-of-network withdrawals. However, many of these fees can be waived by meeting specific requirements, such as maintaining a minimum balance or enrolling in direct deposit.

To avoid unexpected charges, customers are encouraged to review the fee schedule provided by Noble Bank. The bank is transparent about its pricing and offers resources to help customers understand and manage their fees effectively.

Digital Banking Services for Noble Bank Checking Account Holders

Noble Bank is committed to providing cutting-edge digital banking services to enhance the customer experience. In addition to the mobile banking app, the bank offers online bill pay, e-statements, and budgeting tools. These features allow customers to manage their finances conveniently and efficiently.

For businesses, Noble Bank provides specialized digital solutions, such as payroll services, invoicing tools, and expense management systems. These services streamline operations and help businesses save time and money.

Security Measures to Protect Your Noble Bank Checking Account

Security is a top priority for Noble Bank, and the institution employs multiple layers of protection to safeguard customer accounts. These measures include encryption technology, biometric authentication, and real-time fraud monitoring. Customers are also encouraged to use strong passwords and enable two-factor authentication for added security.

In the event of suspicious activity, Noble Bank's fraud detection team will promptly notify account holders and take necessary actions to prevent unauthorized transactions. The bank's zero-liability policy ensures that customers are not held responsible for fraudulent charges.

Customer Support and Assistance

Noble Bank prides itself on offering exceptional customer support. Whether you need assistance with account management, have questions about fees, or require technical support, the bank's representatives are available 24/7 to assist you. Customers can reach out via phone, email, or live chat for prompt and reliable service.

In addition to traditional support channels, Noble Bank provides an extensive knowledge base and FAQ section on its website. These resources cover a wide range of topics and can help customers resolve common issues independently.

Conclusion

Noble Bank checking accounts offer a comprehensive suite of features and benefits designed to meet the diverse needs of individuals and businesses. From user-friendly digital platforms to robust security measures, the bank ensures that its customers have access to the tools and resources they need to manage their finances effectively.

Whether you're looking for a basic account or a premium option with advanced features, Noble Bank has a solution tailored to your needs. By choosing a Noble Bank checking account, you can enjoy convenience, security, and peace of mind knowing that your money is in good hands.

We encourage you to explore the various checking account options offered by Noble Bank and take the first step toward achieving your financial goals. If you have any questions or need further assistance, don't hesitate to reach out to their customer support team. Share this article with friends and family who may benefit from learning about Noble Bank checking accounts!