Are you searching for the American Airlines routing number to facilitate secure and seamless transactions? You've come to the right place. Understanding the routing number is essential for anyone who wants to engage in financial activities involving American Airlines Federal Credit Union. This unique nine-digit code plays a critical role in ensuring that funds are transferred accurately and efficiently. Whether you're setting up direct deposits, making payments, or managing other banking tasks, knowing the correct routing number can save you time and prevent errors.

American Airlines, as one of the largest airlines in the world, provides a range of financial services through its credit union. These services are designed to cater to employees, retirees, and other eligible members. A routing number is a fundamental part of these services, acting as an identifier for the financial institution during transactions. Without it, processes like wire transfers, automatic bill payments, and payroll deposits could face delays or even fail entirely.

In this article, we will explore everything you need to know about the American Airlines routing number. From its definition and purpose to step-by-step guidance on how to locate it, this guide is crafted to ensure you have all the necessary information at your fingertips. We’ll also cover frequently asked questions, common mistakes to avoid, and tips for using the routing number effectively. Let’s dive in!

Read also:Discover The Enigmatic World Of Ms Sethi A Comprehensive Guide

Table of Contents

What is a Routing Number?

A routing number, also known as an ABA (American Bankers Association) routing transit number, is a nine-digit code used by banks and credit unions in the United States to identify the financial institution responsible for a particular account. This number is essential for processing various types of electronic transactions, including direct deposits, wire transfers, and automatic bill payments.

Each financial institution has its own unique routing number, which ensures that funds are directed to the correct bank or credit union. For example, the American Airlines routing number is specifically assigned to the American Airlines Federal Credit Union, enabling it to participate in national and international banking networks.

How Routing Numbers Work

Routing numbers function as addresses for financial institutions. When you initiate a transaction, such as setting up a direct deposit or transferring money online, the routing number tells the system where to send the funds. Here’s how it works:

- The sender provides the recipient’s account number and routing number.

- The routing number identifies the recipient’s bank or credit union.

- The funds are transferred from the sender’s account to the recipient’s account via the appropriate financial institution.

This process is quick, secure, and widely used across industries, making routing numbers indispensable for modern banking.

Why Do You Need the American Airlines Routing Number?

The American Airlines routing number is crucial for anyone who holds an account with the American Airlines Federal Credit Union. Below are some specific scenarios where this routing number comes into play:

- Direct Deposits: If you’re an employee of American Airlines or another eligible member, you may want to set up direct deposits for your paycheck. Providing the correct routing number ensures that your salary is deposited into your account without delays.

- Automatic Bill Payments: Many individuals use automatic bill payments to manage recurring expenses like utility bills, subscriptions, or loans. The routing number allows these payments to be processed smoothly.

- Wire Transfers: Whether you’re sending or receiving money internationally or domestically, the routing number is required to complete the transaction.

- Tax Refunds: If you’re expecting a tax refund and want it deposited directly into your account, you’ll need to provide the routing number to the IRS or relevant tax authority.

Without the correct routing number, these transactions may fail, leading to unnecessary complications and delays.

Read also:Sophie Rain Unveiling The Life And Career Of A Rising Star

How to Find the American Airlines Routing Number

Finding the American Airlines routing number is straightforward if you know where to look. Below are several methods to locate it:

1. Check Your Checks

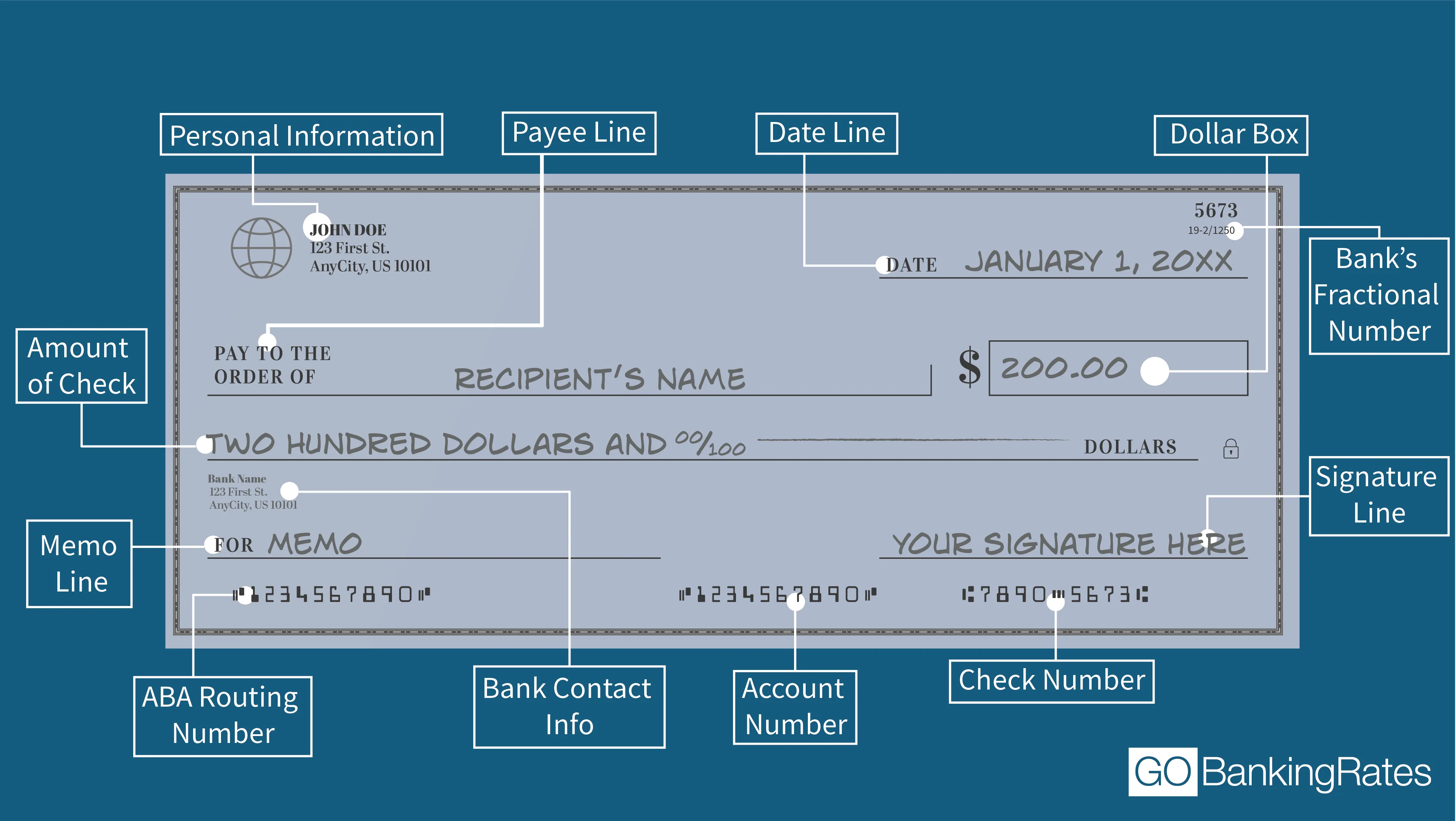

If you have physical checks issued by the American Airlines Federal Credit Union, the routing number is printed at the bottom left corner of each check. It appears as the first set of nine digits before your account number.

2. Visit the Official Website

The American Airlines Federal Credit Union’s official website provides detailed information about their routing number. You can typically find this information under sections like “Account Services” or “FAQs.” Always verify that you are on the legitimate website to avoid scams.

3. Contact Customer Support

If you’re unable to locate the routing number through other means, contacting customer support is a reliable option. Representatives can provide the routing number over the phone or via email after verifying your identity.

4. Mobile Banking App

Members who use the American Airlines Federal Credit Union’s mobile banking app can often find the routing number within the app’s settings or account details section.

How to Use the Routing Number

Once you’ve obtained the American Airlines routing number, it’s important to understand how to use it properly. Below are step-by-step instructions for common use cases:

Setting Up Direct Deposits

To set up direct deposits, follow these steps:

- Provide your employer or payer with your account number and the American Airlines routing number.

- Confirm the details to ensure accuracy.

- Monitor your account to verify that the deposit has been processed successfully.

Making Wire Transfers

For wire transfers, the process may vary slightly depending on the sender’s bank. However, the general steps include:

- Provide the recipient’s account number, the American Airlines routing number, and any additional required information (such as SWIFT codes for international transfers).

- Initiate the transfer through your bank’s online platform or branch office.

- Track the status of the transfer to ensure it reaches the intended account.

Common Mistakes When Using Routing Numbers

While routing numbers are relatively simple to use, errors can still occur. Below are some common mistakes and how to avoid them:

- Using the Wrong Routing Number: Double-check the routing number before initiating any transaction. Using an incorrect number can result in funds being sent to the wrong institution.

- Mixing Up Account Numbers: Ensure that you provide the correct account number along with the routing number. Mixing these up can lead to failed transactions.

- Ignoring Updates: Occasionally, financial institutions may change their routing numbers. Stay informed about any updates by regularly checking the official website or contacting customer support.

Security Tips for Using Routing Numbers

Protecting your financial information is paramount. Here are some tips to safeguard your routing number and account details:

- Do Not Share Publicly: Never share your routing number or account number on social media or unsecured platforms.

- Verify Sources: Only provide your routing number to trusted entities, such as your employer or verified financial institutions.

- Monitor Your Accounts: Regularly review your bank statements and transaction history to detect any unauthorized activity.

Frequently Asked Questions

What is the American Airlines routing number?

The American Airlines routing number is a unique nine-digit code assigned to the American Airlines Federal Credit Union. It is used for various financial transactions, including direct deposits and wire transfers.

Can I use the same routing number for all types of transactions?

Yes, the same routing number is generally used for most transactions. However, international wire transfers may require additional codes, such as SWIFT codes.

How do I know if I have the correct routing number?

You can confirm the routing number by checking your checks, visiting the official website, or contacting customer support.

Additional Resources

For further reading and verification, consider exploring the following resources:

- American Airlines Federal Credit Union’s official website.

- Financial guides and articles from reputable sources like the Consumer Financial Protection Bureau (CFPB).

- Banking forums and communities where users share tips and experiences.

Conclusion

Understanding the American Airlines routing number is vital for anyone who needs to conduct financial transactions through the American Airlines Federal Credit Union. From setting up direct deposits to making wire transfers, this nine-digit code ensures that your funds are transferred accurately and efficiently. By following the guidelines outlined in this article, you can confidently use the routing number for various purposes while avoiding common mistakes.

If you found this guide helpful, please consider sharing it with others who might benefit from the information. Additionally, feel free to leave a comment or explore more articles on our site to deepen your knowledge about personal finance and banking. Your financial security is our priority, and we’re here to assist you every step of the way!