Are you looking for a reliable way to protect your business from unexpected liabilities? HPSO liability insurance might be the solution you need. In today’s fast-paced world, businesses face numerous risks that can lead to costly lawsuits. Whether you’re a healthcare professional, a small business owner, or a contractor, having the right liability insurance is crucial to safeguarding your assets and reputation. HPSO (Healthcare Providers Service Organization) is a leading provider of liability insurance tailored to meet the needs of various professionals. In this article, we will explore everything you need to know about HPSO liability insurance, its benefits, and how it can protect your business.

Liability insurance is not just an optional expense; it’s a necessity for anyone who interacts with clients, customers, or patients. A single lawsuit can drain your financial resources and damage your professional reputation. HPSO liability insurance offers comprehensive coverage designed to address the unique risks faced by different industries. From medical malpractice to general liability, HPSO provides tailored solutions to ensure you are protected against unforeseen circumstances.

In the following sections, we will delve deeper into the specifics of HPSO liability insurance, including its features, benefits, and how it compares to other insurance options. By the end of this article, you will have a clear understanding of why HPSO liability insurance is a smart investment for your business and how it can provide peace of mind in an unpredictable world.

Read also:Discover The Latest Wasmo Cusub Telegram Your Ultimate Guide

Table of Contents

- What is HPSO Liability Insurance?

- Key Features of HPSO Liability Insurance

- Benefits of HPSO Liability Insurance

- Who Needs HPSO Liability Insurance?

- How to Choose the Right Coverage

- Cost of HPSO Liability Insurance

- HPSO vs. Other Insurance Providers

- How to File a Claim with HPSO

- Common Misconceptions About HPSO Liability Insurance

- Conclusion

What is HPSO Liability Insurance?

HPSO liability insurance is a specialized form of insurance designed to protect professionals and businesses from financial losses arising from liability claims. It is particularly popular among healthcare providers, but it also caters to other industries such as consulting, education, and construction. HPSO offers a variety of coverage options, including professional liability, general liability, and cyber liability insurance.

Types of Coverage Offered by HPSO

- Professional Liability Insurance: Protects against claims of negligence or errors in professional services.

- General Liability Insurance: Covers bodily injury, property damage, and advertising injury claims.

- Cyber Liability Insurance: Provides coverage for data breaches and cyberattacks.

HPSO’s policies are designed to be flexible, allowing businesses to customize their coverage based on their specific needs. This adaptability makes HPSO a preferred choice for professionals across various industries.

Key Features of HPSO Liability Insurance

One of the standout features of HPSO liability insurance is its comprehensive coverage. Here are some of the key features that make HPSO a trusted name in the insurance industry:

1. Tailored Coverage

HPSO offers policies that are specifically designed to address the unique risks faced by different professions. For example, healthcare providers can opt for medical malpractice coverage, while consultants can choose professional liability insurance.

2. Affordable Premiums

HPSO provides competitive pricing, making it accessible for small businesses and independent professionals. The premiums are often lower than those of other insurance providers, thanks to HPSO’s extensive experience in the industry.

3. 24/7 Claims Support

HPSO offers round-the-clock claims support, ensuring that policyholders can get assistance whenever they need it. This feature is particularly valuable in emergencies, where quick action can make a significant difference.

Read also:Shubhashree Sahu A Comprehensive Guide To Her Life Career And Achievements

4. Risk Management Resources

In addition to insurance coverage, HPSO provides policyholders with access to risk management resources. These resources include training materials, webinars, and guides to help businesses minimize their exposure to risks.

Benefits of HPSO Liability Insurance

Investing in HPSO liability insurance offers numerous benefits that go beyond financial protection. Here are some of the key advantages:

1. Peace of Mind

Knowing that you are protected against potential lawsuits allows you to focus on growing your business without worrying about unforeseen liabilities.

2. Enhanced Credibility

Having HPSO liability insurance demonstrates to clients and partners that you are a responsible and trustworthy professional. This can enhance your reputation and attract more business opportunities.

3. Legal Defense Coverage

HPSO policies often include coverage for legal defense costs, which can be a significant financial burden in the event of a lawsuit.

4. Customizable Policies

HPSO allows businesses to tailor their policies to meet their specific needs, ensuring that they only pay for the coverage they require.

Who Needs HPSO Liability Insurance?

HPSO liability insurance is ideal for a wide range of professionals and businesses. Here are some examples of individuals and organizations that can benefit from HPSO’s coverage:

- Healthcare Professionals: Doctors, nurses, therapists, and other healthcare providers need protection against medical malpractice claims.

- Consultants: Business consultants, IT consultants, and other professionals can benefit from professional liability insurance.

- Educators: Teachers, trainers, and educational institutions can protect themselves against claims related to their services.

- Small Business Owners: Retailers, contractors, and service providers can safeguard their businesses with general liability insurance.

How to Choose the Right Coverage

Selecting the right HPSO liability insurance policy requires careful consideration of your business’s specific needs. Here are some tips to help you make an informed decision:

1. Assess Your Risks

Identify the potential risks your business faces and choose a policy that addresses those risks. For example, a healthcare provider may prioritize medical malpractice coverage, while a consultant may focus on professional liability.

2. Compare Quotes

Request quotes from multiple insurance providers, including HPSO, to compare pricing and coverage options. This will help you find the best value for your money.

3. Review Policy Terms

Carefully review the terms and conditions of the policy, including exclusions and limitations. Make sure you understand what is covered and what is not.

Cost of HPSO Liability Insurance

The cost of HPSO liability insurance varies depending on several factors, including the type of coverage, the size of the business, and the level of risk involved. On average, premiums can range from a few hundred to several thousand dollars per year. To get an accurate estimate, it’s best to contact HPSO directly or work with an insurance broker.

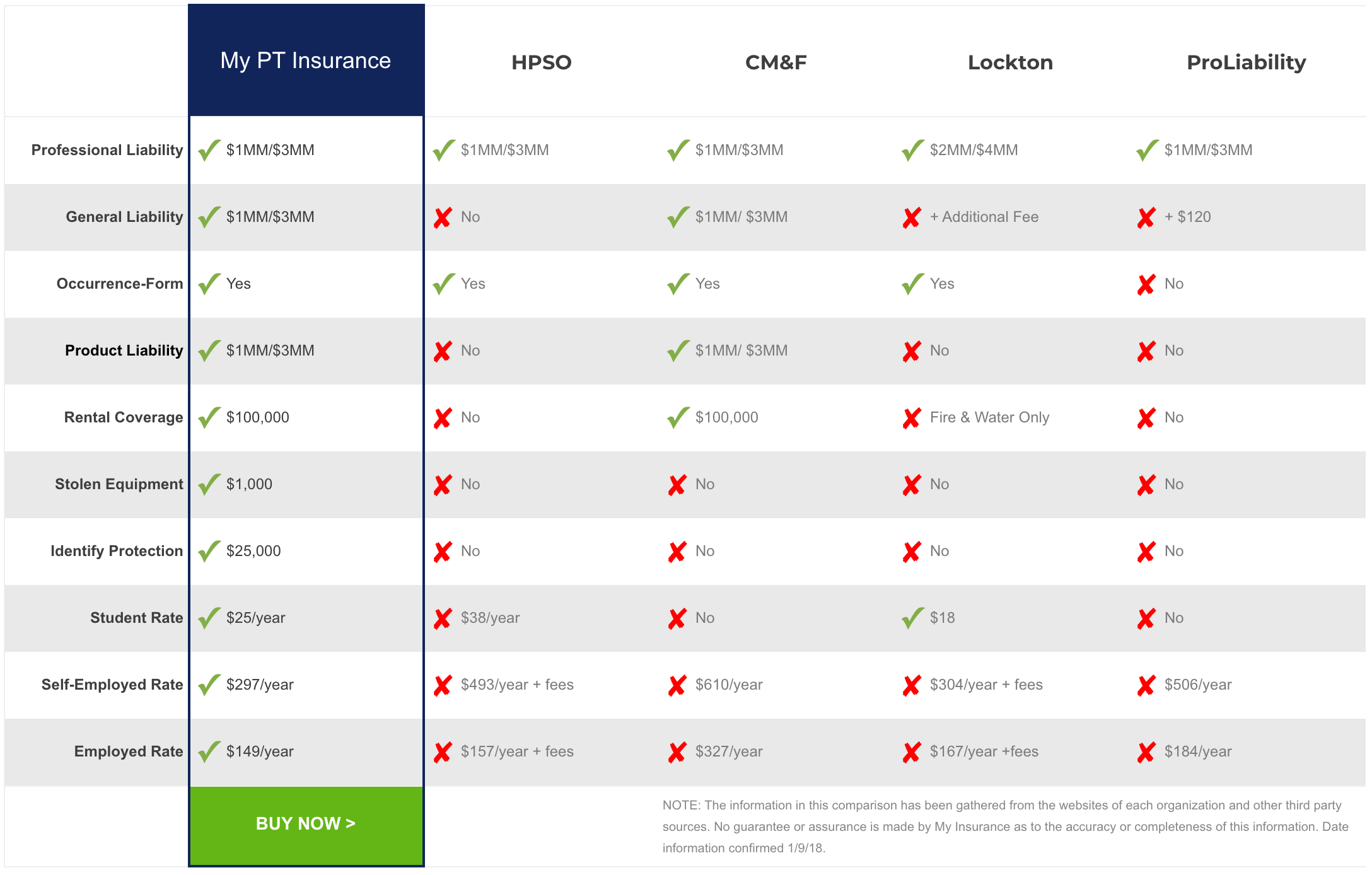

HPSO vs. Other Insurance Providers

When comparing HPSO to other insurance providers, several factors set it apart:

- Industry Expertise: HPSO has decades of experience in providing liability insurance to professionals.

- Customizable Policies: Unlike many providers, HPSO allows businesses to tailor their coverage to their specific needs.

- Competitive Pricing: HPSO offers affordable premiums without compromising on coverage quality.

How to File a Claim with HPSO

Filing a claim with HPSO is a straightforward process. Here are the steps you need to follow:

- Notify HPSO: Contact HPSO’s claims department as soon as possible to report the incident.

- Submit Documentation: Provide all relevant documentation, including incident reports and witness statements.

- Work with Claims Adjusters: Collaborate with HPSO’s claims adjusters to resolve the claim efficiently.

Common Misconceptions About HPSO Liability Insurance

Despite its popularity, there are several misconceptions about HPSO liability insurance. Here are some common myths debunked:

1. “HPSO Only Covers Healthcare Providers”

While HPSO is well-known for its medical malpractice coverage, it also offers liability insurance for a wide range of professions.

2. “HPSO Policies Are Expensive”

In reality, HPSO offers competitive pricing and flexible payment options, making it accessible for businesses of all sizes.

Conclusion

HPSO liability insurance is an essential tool for protecting your business from unforeseen liabilities. With its comprehensive coverage, competitive pricing, and industry expertise, HPSO stands out as a trusted provider in the insurance market. Whether you’re a healthcare professional, a consultant, or a small business owner, HPSO offers tailored solutions to meet your unique needs.

Don’t wait until it’s too late—invest in HPSO liability insurance today to safeguard your business and ensure peace of mind. If you have any questions or would like to learn more, feel free to leave a comment below or share this article with others who might benefit from it. For additional resources, check out our other articles on business insurance and risk management.