Table of Contents

Introduction

Bank of America wire routing number is an essential component for anyone conducting financial transactions, particularly wire transfers. Whether you're sending money domestically or internationally, understanding the role of routing numbers is crucial to ensure your transactions are processed accurately and securely. In today's digital age, where online banking and electronic transfers are becoming the norm, having a clear understanding of how routing numbers work can save you time, money, and potential headaches.

Routing numbers, also known as ABA (American Bankers Association) numbers, are nine-digit codes used by banks to identify specific financial institutions within the United States. These numbers play a vital role in various banking transactions, including direct deposits, bill payments, and wire transfers. Bank of America, being one of the largest financial institutions in the country, utilizes multiple routing numbers across its vast network of branches and services.

This comprehensive guide will walk you through everything you need to know about Bank of America's wire routing numbers. From understanding what routing numbers are and how they differ from other types of banking codes to providing practical tips for secure transactions, this article aims to be your ultimate resource for navigating the world of wire transfers with Bank of America.

Read also:Robert Jamescolliers Wife Meet Name

What is a Routing Number?

A routing number is a nine-digit code that identifies financial institutions in the United States. It was developed by the American Bankers Association (ABA) in 1910 to facilitate the processing and clearing of checks and other financial transactions. Each bank or credit union has its own unique routing number, which is used to direct funds to the correct financial institution.

The structure of a routing number follows a specific format:

- First four digits: Federal Reserve Routing Symbol

- Next four digits: ABA Institution Identifier

- Last digit: Check Digit

Routing numbers are essential for various banking operations, including:

- Direct deposit of payroll

- Automatic bill payments

- Check processing

- Wire transfers

Types of Routing Numbers

Standard Routing Numbers

These are used for domestic transactions within the United States, primarily for ACH (Automated Clearing House) transfers and paper checks.

Wire Transfer Routing Numbers

Specifically designed for wire transfers, these numbers may differ from standard routing numbers. They ensure that funds are directed correctly through the Federal Reserve System or other wire transfer networks.

International Routing Numbers

For international transactions, additional codes such as SWIFT/BIC codes are used alongside routing numbers to facilitate cross-border transfers.

Read also:Shubshree Sahu Mms Unveiling The Controversy And Its Impact

Bank of America Wire Routing Number

Bank of America uses different routing numbers depending on the location and type of transaction. The primary wire routing number for Bank of America is 026009593. However, it's crucial to verify the correct number based on your specific needs and location.

Here's a breakdown of Bank of America's routing numbers:

- Domestic Wire Transfers: 026009593

- International Wire Transfers: 026009593 (plus additional information)

- ACH Transfers: Varies by state

It's important to note that Bank of America may use different routing numbers for different states and transaction types. Always verify the correct number through official Bank of America channels to ensure accurate processing of your transactions.

How to Find Your Routing Number

Finding your correct routing number is crucial for successful transactions. Here are several reliable methods to locate your Bank of America routing number:

Check Your Checks

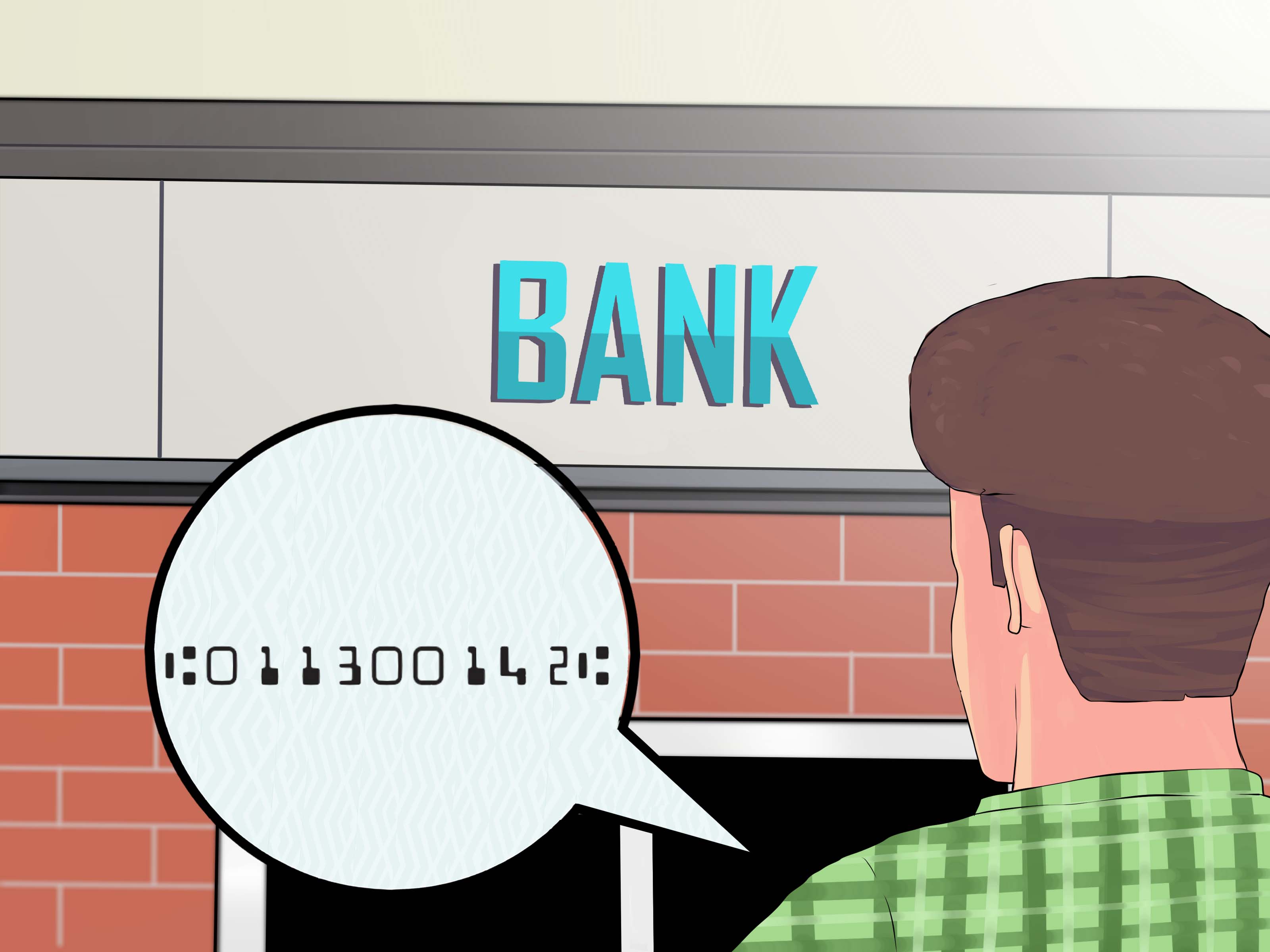

The routing number is typically printed on the bottom left corner of your checks. It appears before your account number and check number.

Online Banking

Log in to your Bank of America online account and navigate to the routing number section. The bank provides specific routing numbers based on your account type and location.

Bank of America Website

Visit the official Bank of America website and use their routing number lookup tool. This tool allows you to search by state and transaction type.

Customer Service

Contact Bank of America's customer service for verification. They can provide the correct routing number based on your specific needs and location.

Common Uses of Routing Numbers

Routing numbers serve various purposes in daily banking operations. Here are the most common uses:

Direct Deposits

Employers use routing numbers to deposit salaries directly into employees' accounts. This ensures timely and accurate payment processing.

Automatic Bill Payments

Utility companies and other service providers use routing numbers to withdraw payments automatically from customers' accounts.

Check Processing

When you write a check, the routing number helps banks identify where to send the funds for processing and clearing.

Wire Transfers

Both domestic and international wire transfers require specific routing numbers to ensure funds reach the correct destination.

Wire Transfers with Bank of America

Bank of America offers robust wire transfer services for both domestic and international transactions. Understanding their wire transfer process is crucial for successful transactions:

Domestic Wire Transfers

For transfers within the United States:

- Use routing number 026009593

- Include recipient's account number

- Specify the amount and purpose of transfer

Processing Time

Domestic wire transfers typically process within the same business day if initiated before the cutoff time. Transfers initiated after hours may take an additional business day.

Fees

Bank of America charges a fee for wire transfers:

- Outgoing domestic: $30

- Incoming domestic: $15

International Wire Transfers

For international transactions, additional information is required beyond the standard routing number:

Required Information

- SWIFT/BIC code

- Recipient's full name and address

- Recipient's bank name and address

- IBAN (International Bank Account Number) if applicable

Processing Time

International wire transfers typically take 1-5 business days, depending on the destination and intermediary banks involved.

Fees

International wire transfer fees include:

- Outgoing international: $45

- Incoming international: $16

- Potential intermediary bank fees

Security Tips for Wire Transfers

Wire transfers, while convenient, can be susceptible to fraud. Follow these security measures to protect your transactions:

Verify Recipient Information

Double-check all recipient details, including:

- Account number

- Routing number

- Recipient's name and address

Use Secure Channels

Always initiate wire transfers through official Bank of America channels:

- Secure online banking portal

- Official mobile banking app

- Verified customer service numbers

Monitor Your Accounts

Regularly check your account statements and transaction history for any unauthorized activity.

Frequently Asked Questions

What is the difference between ACH and wire transfer routing numbers?

ACH routing numbers are typically used for electronic transfers like direct deposits, while wire transfer routing numbers are specifically for wire transfers. They may differ for the same bank.

Can I use the same routing number for all types of transactions?

No, different transaction types may require different routing numbers. Always verify the correct number for your specific transaction.

Is the routing number the same across all Bank of America branches?

No, routing numbers can vary by state and transaction type. It's essential to use the correct number for your location and transaction.

Conclusion

Understanding and correctly using Bank of America's wire routing number is crucial for successful financial transactions. Whether you're conducting domestic wire transfers or international transactions, having the correct routing information ensures your funds reach their destination accurately and efficiently.

Remember to always verify your routing numbers through official Bank of America channels and double-check all transaction details before initiating transfers. The security tips provided in this guide can help protect your financial transactions from potential fraud.

If you found this guide helpful, please consider sharing it with others who might benefit from this information. For more banking tips and financial advice, explore our other articles on secure banking practices and financial management. Have questions or experiences to share? Leave a comment below and join the conversation!