Are you planning to purchase a car and want to simplify the financing process? Capital One Auto Pre-Approval could be your ultimate solution. Capital One, a trusted financial institution, offers a seamless pre-approval process that allows you to determine your car-buying budget and secure favorable loan terms before visiting a dealership. This service not only saves time but also empowers you to negotiate confidently with dealers. In this article, we will explore everything you need to know about Capital One Auto Pre-Approval, from its benefits to the application process and tips for maximizing your approval chances.

Capital One Auto Pre-Approval is designed to simplify your car-buying experience by providing a clear understanding of your financial standing. Whether you're a first-time car buyer or looking to upgrade your vehicle, this service ensures you are well-prepared for the journey ahead. With Capital One's reputation for reliability and customer-centric solutions, their pre-approval process has become a popular choice for many consumers. This guide will walk you through the steps, requirements, and strategies to make the most of this opportunity.

By the end of this article, you will have a comprehensive understanding of how Capital One Auto Pre-Approval works, its advantages, and how it fits into the broader context of car financing. We will also address frequently asked questions, provide actionable tips, and share expert insights to help you navigate the process with confidence. Let’s dive in and explore how this service can transform your car-buying experience.

Read also:Girth Master And Miaz A Comprehensive Guide To Understanding Their Impact And Influence

Table of Contents

- What is Capital One Auto Pre-Approval?

- Benefits of Capital One Auto Pre-Approval

- How to Apply for Capital One Auto Pre-Approval

- Requirements for Capital One Auto Pre-Approval

- Understanding Your Pre-Approval Offer

- Tips to Increase Your Chances of Approval

- How Capital One Compares to Other Lenders

- Common Mistakes to Avoid

- Frequently Asked Questions

- Conclusion

What is Capital One Auto Pre-Approval?

Capital One Auto Pre-Approval is a financial service that allows potential car buyers to determine their eligibility for an auto loan before visiting a dealership. This process involves a soft credit inquiry, which does not impact your credit score, and provides you with an estimated loan amount and interest rate based on your financial profile. By securing pre-approval, you gain a clear understanding of your budget and can focus on finding a car that fits your financial capabilities.

This service is particularly beneficial for individuals who want to streamline the car-buying process. Instead of negotiating with dealerships while uncertain about financing, pre-approval gives you the confidence to shop for a car knowing exactly how much you can afford. Capital One's pre-approval process is user-friendly and can be completed online, making it accessible to a wide range of consumers.

How Pre-Approval Works

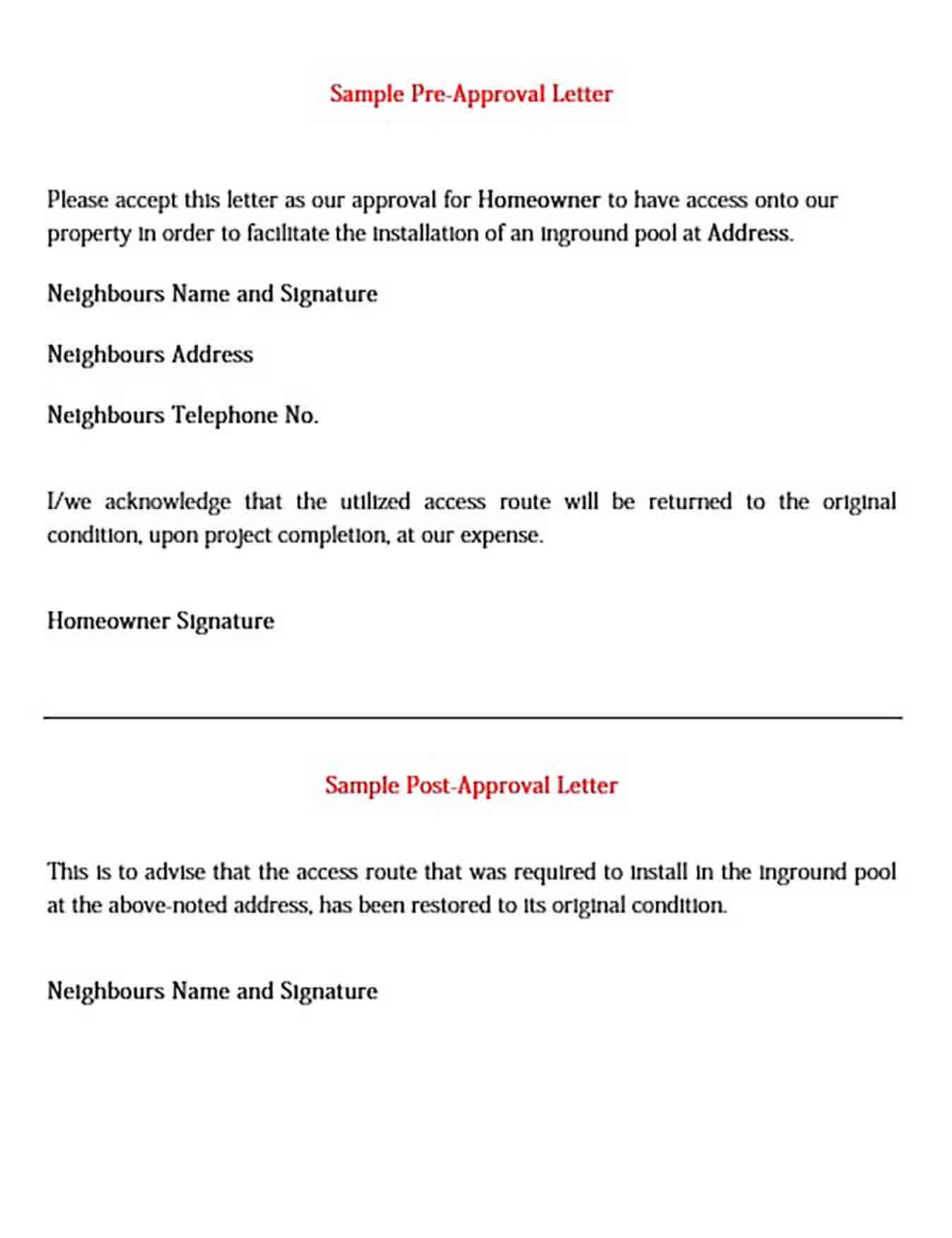

The pre-approval process typically involves submitting an application with basic financial information, such as your income, credit score, and employment details. Once approved, you will receive a pre-approval letter outlining the loan terms, including the maximum loan amount and estimated interest rate. This letter serves as a valuable tool when negotiating with dealerships, as it demonstrates your financial readiness and commitment to purchasing a vehicle.

Benefits of Capital One Auto Pre-Approval

Capital One Auto Pre-Approval offers several advantages that make it an attractive option for car buyers. Below are some of the key benefits:

- Budget Clarity: Knowing your pre-approved loan amount helps you set a realistic budget and avoid overspending.

- Negotiation Power: Armed with a pre-approval letter, you can negotiate with dealerships from a position of strength.

- No Credit Impact: The soft credit inquiry used in the pre-approval process does not affect your credit score.

- Time-Saving: Pre-approval simplifies the financing process, allowing you to focus on selecting the right car.

- Competitive Rates: Capital One offers competitive interest rates, ensuring you secure a favorable deal.

Additional Perks

Beyond the primary benefits, Capital One also provides access to a network of trusted dealerships and tools to help you compare vehicles and loan offers. These resources ensure you make an informed decision and choose the best option for your needs.

How to Apply for Capital One Auto Pre-Approval

Applying for Capital One Auto Pre-Approval is a straightforward process that can be completed online in a few simple steps. Follow the guide below to get started:

Read also:Masa49 Expert A Comprehensive Guide To Mastering Expertise In The Digital Age

Step 1: Gather Your Financial Information

Before starting the application, ensure you have the following details ready:

- Your Social Security Number (SSN)

- Proof of income (e.g., pay stubs, tax returns)

- Employment details

- Current monthly expenses

Step 2: Complete the Online Application

Visit Capital One's official website and navigate to the Auto Pre-Approval section. Fill out the application form with the required information. The process typically takes 10-15 minutes to complete.

Step 3: Review Your Pre-Approval Offer

Once your application is processed, you will receive a pre-approval offer outlining the loan terms. Take the time to review the details carefully and ensure they align with your financial goals.

Requirements for Capital One Auto Pre-Approval

To qualify for Capital One Auto Pre-Approval, you must meet certain eligibility criteria. These requirements are designed to ensure you can responsibly manage the loan and make timely payments.

Basic Eligibility Criteria

- Minimum age of 18 years

- Valid U.S. residency

- Stable source of income

- Good to excellent credit score (typically 660 or higher)

- Low debt-to-income ratio

Documentation Needed

You may be required to provide supporting documents to verify your financial information. These may include:

- Proof of income (e.g., recent pay stubs)

- Bank statements

- Employment verification letter

- Identification documents (e.g., driver's license)

Understanding Your Pre-Approval Offer

Once you receive your Capital One Auto Pre-Approval offer, it’s essential to understand the terms and conditions to make an informed decision. Below are the key components of a pre-approval offer:

- Loan Amount: The maximum amount you are eligible to borrow.

- Interest Rate: The annual percentage rate (APR) you will be charged for the loan.

- Loan Term: The duration of the loan, typically ranging from 36 to 72 months.

- Monthly Payment Estimate: An approximation of your monthly payment based on the loan terms.

How to Compare Offers

If you receive multiple pre-approval offers, compare the interest rates, loan terms, and fees to determine the best option. Capital One provides tools to help you evaluate offers and make a confident decision.

Tips to Increase Your Chances of Approval

While Capital One Auto Pre-Approval is designed to be accessible, there are steps you can take to improve your chances of qualifying for favorable terms. Consider the following tips:

- Improve Your Credit Score: Pay down existing debt and resolve any credit report errors before applying.

- Reduce Debt-to-Income Ratio: Lower your monthly expenses or increase your income to improve this ratio.

- Provide Accurate Information: Ensure all details in your application are truthful and up-to-date.

- Save for a Down Payment: A larger down payment can reduce the loan amount and improve your approval odds.

Additional Strategies

If your application is denied, consider working with a co-signer or exploring alternative financing options. Capital One also offers resources to help you understand the reasons for denial and how to address them.

How Capital One Compares to Other Lenders

Capital One is just one of many lenders offering auto pre-approval services. To help you make an informed decision, let’s compare Capital One with other popular lenders:

| Lender | Minimum Credit Score | Loan Terms | APR Range |

|---|---|---|---|

| Capital One | 660 | 36-72 months | 4.99%-24.99% |

| Bank of America | 680 | 24-75 months | 3.99%-25.99% |

| Chase | 700 | 36-84 months | 3.74%-24.99% |

Why Choose Capital One?

Capital One stands out for its user-friendly application process, competitive rates, and extensive dealer network. Additionally, their customer service and digital tools make the experience seamless and stress-free.

Common Mistakes to Avoid

While Capital One Auto Pre-Approval is a valuable tool, there are common pitfalls to watch out for. Avoid these mistakes to ensure a smooth process:

- Applying Without Research: Understand your financial situation and compare offers before committing.

- Ignoring the Fine Print: Review all terms and conditions to avoid surprises later.

- Overlooking Dealer Financing: Compare Capital One’s offer with dealership financing options to secure the best deal.

- Not Checking Your Credit Report: Errors on your credit report can impact your approval chances.

Frequently Asked Questions

1. Does Capital One Auto Pre-Approval Guarantee Loan Approval?

No, pre-approval does not guarantee final loan approval. The dealership may require additional documentation or verification before finalizing the loan.

2. How Long Does Pre-Approval Last?

Capital One Auto Pre-Approval is typically valid for 30 days, giving you ample time to shop for a car.

3. Can I Use Pre-Approval at Any Dealership?

Yes, Capital One’s pre-approval can be used at any dealership within their network. However, some dealerships may have exclusive partnerships with other lenders.

Conclusion

Capital One Auto Pre-Approval is a powerful tool that simplifies the car-buying process and empowers you to make informed financial decisions. By understanding the benefits, requirements, and application process, you can navigate this service with confidence and secure the best possible deal. Remember to compare offers, avoid common mistakes, and leverage Capital One’s resources to maximize your experience.

Now that you’re equipped with the knowledge to take advantage of Capital One Auto Pre-Approval, it’s time to take action. Start your application today, and don’t hesitate to reach out to Capital One’s customer support team if you have any questions. Share this article with