Buying a home is one of the most significant financial decisions you'll ever make, and understanding the associated costs is crucial. One key aspect of purchasing a home is the closing costs, which can often catch buyers off guard if they're not adequately prepared. For those considering a Costco mortgage, it's essential to delve into the specifics of these closing costs to ensure a smooth and transparent home-buying process. This guide will provide a detailed breakdown of Costco mortgage closing costs, helping you navigate this critical phase of homeownership with confidence.

When it comes to Costco mortgages, many potential homebuyers are drawn to the prospect of securing a loan through a trusted brand. Costco, known for its commitment to quality and value, has partnered with reputable lenders to offer mortgage services to its members. However, like any mortgage, there are closing costs involved that can impact your overall financial planning. Understanding these costs is not only vital for budgeting purposes but also for ensuring that you're getting the best possible deal on your home loan.

In this article, we'll explore everything you need to know about Costco mortgage closing costs. From breaking down what these costs include to providing tips on how to minimize them, we aim to equip you with the knowledge necessary to make informed decisions. Whether you're a first-time homebuyer or looking to refinance, this comprehensive guide will help you navigate the complexities of closing costs associated with Costco mortgages.

Read also:Exploring The World Of Www Masa49 Com A Comprehensive Guide

Table of Contents

- What Are Closing Costs?

- Costco Mortgage Overview

- Breakdown of Costco Mortgage Closing Costs

- How to Minimize Costco Mortgage Closing Costs

- Costco Mortgage Partners and Their Role

- Comparison with Other Mortgage Lenders

- Common Mistakes to Avoid

- Benefits of Choosing Costco Mortgage

- Frequently Asked Questions

- Conclusion

What Are Closing Costs?

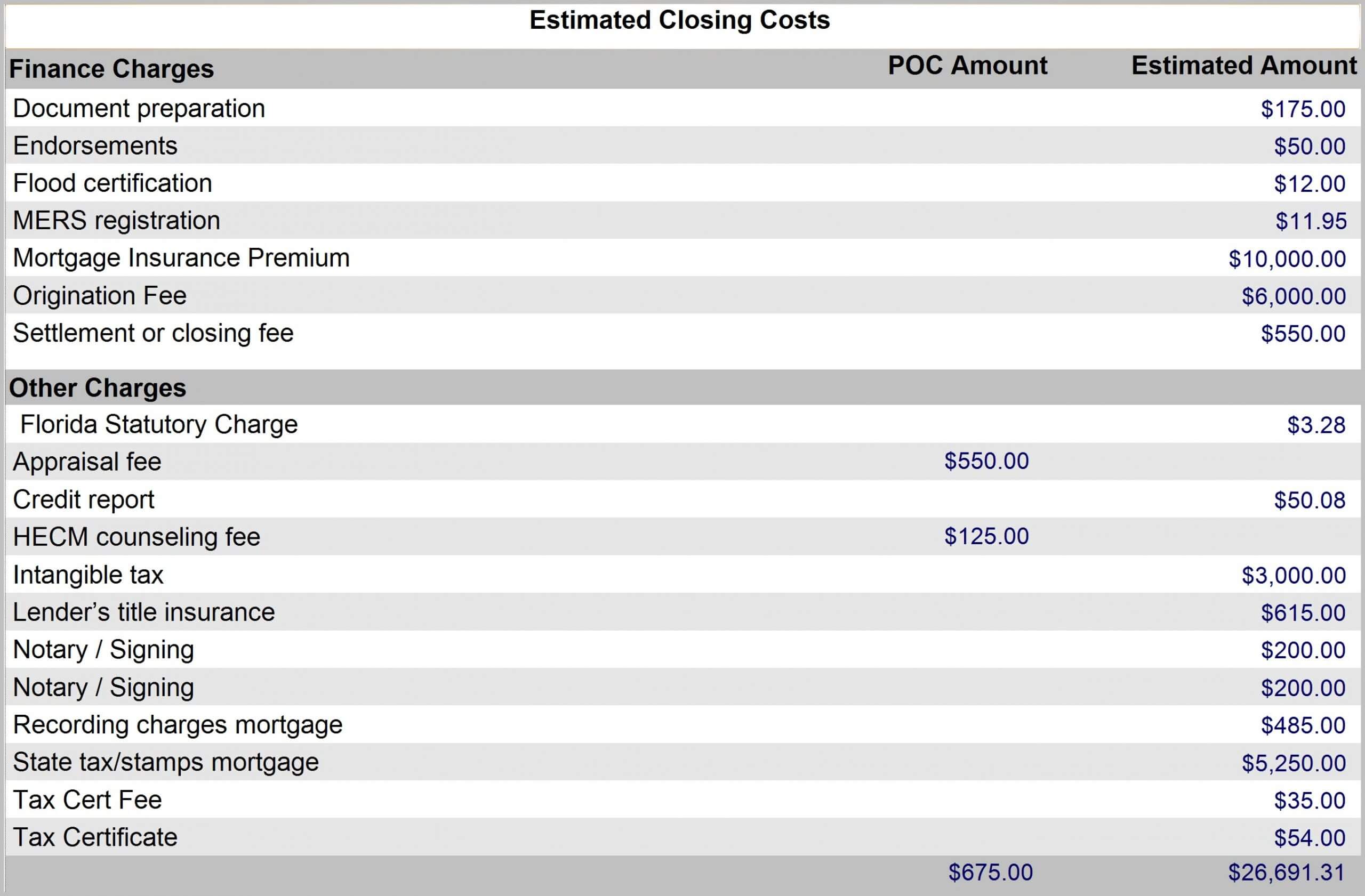

Closing costs are fees and expenses that buyers and sellers incur during the home-buying process. These costs typically range from 2% to 5% of the loan amount and cover various services required to finalize the mortgage. Understanding these costs is crucial because they can significantly impact your overall budget when purchasing a home.

Types of Closing Costs

- Loan Origination Fees: Charged by the lender for processing the new loan application.

- Appraisal Fees: Paid to have the property professionally evaluated.

- Title Insurance: Protects the lender and buyer against any ownership disputes.

- Prepaid Interest: Interest paid upfront for the period between closing and the first mortgage payment.

- Escrow Deposits: Funds set aside for property taxes and insurance.

These costs can vary depending on several factors, including the loan amount, location, and lender policies. It's essential to review your Loan Estimate document carefully to understand all potential fees.

Costco Mortgage Overview

Costco, in partnership with reputable lenders, offers mortgage services exclusively to its members. The program aims to provide competitive rates and transparent terms, leveraging Costco's strong brand reputation for value and quality. This section explores how Costco's mortgage program works and what sets it apart from traditional lenders.

How Costco Mortgage Works

Costco Mortgage operates through a network of approved lenders who offer special rates and terms to Costco members. The process typically involves:

- Membership Verification: Only Costco members can access these exclusive mortgage offers.

- Pre-Approval Process: Members can get pre-approved for a mortgage, helping them understand their budget.

- Customized Loan Options: Various loan products are available, including fixed-rate and adjustable-rate mortgages.

While Costco doesn't directly originate loans, its partnerships ensure that members receive competitive terms and dedicated customer service.

Breakdown of Costco Mortgage Closing Costs

Costco mortgage closing costs typically include several components that are standard across most mortgage transactions. However, the exact amounts can vary based on specific circumstances. Here's a detailed breakdown:

Read also:Robyn Millan Cause Of Death Unraveling The Mystery Behind Her Untimely Passing

Loan Origination Fees

These fees cover the lender's administrative costs for processing your mortgage application. With Costco mortgages, these fees are often competitive due to the volume of business generated through the program.

Title Services

Title insurance and related services protect both the lender and the buyer from potential legal issues regarding property ownership. Costco's partners usually offer competitive rates for these services.

Appraisal and Inspection Fees

Professional appraisals and inspections are crucial for determining the property's value and condition. Costco's network of approved service providers often offers these services at reduced rates for members.

Prepaid Items

These include prepaid interest, property taxes, and homeowners insurance. While these costs are standard across all mortgages, Costco members may benefit from volume discounts or special arrangements with service providers.

How to Minimize Costco Mortgage Closing Costs

While closing costs are inevitable, there are several strategies you can employ to minimize these expenses:

Shop Around for Services

Although Costco has preferred service providers, you're not obligated to use them. Shopping around for services like title insurance and inspections can help you find better rates.

Negotiate with the Seller

In a competitive market, sellers may be willing to contribute to closing costs as part of the negotiation process. This can significantly reduce your out-of-pocket expenses.

Timing Your Closing

Closing at the end of the month can reduce prepaid interest costs, as you'll pay less interest upfront before your first mortgage payment is due.

Costco Mortgage Partners and Their Role

Costco's mortgage program relies on a network of trusted partners to deliver services to its members. These partners include:

- Primary Lenders: Institutions that originate and service the loans.

- Title Companies: Providers of title insurance and related services.

- Appraisal Services: Professional firms conducting property evaluations.

These partners are carefully selected based on their reputation, service quality, and ability to offer competitive terms to Costco members.

Comparison with Other Mortgage Lenders

When evaluating Costco mortgages against other lenders, several factors stand out:

Competitive Rates

Due to Costco's buying power, members often receive preferential rates compared to traditional lenders. However, it's essential to compare these rates with other offers to ensure you're getting the best deal.

Member Benefits

Costco members may receive additional perks, such as reduced fees or special loan terms, that aren't available through other lenders.

Service Quality

While rates are important, the quality of service and support throughout the mortgage process is equally crucial. Costco's partners typically offer dedicated support for members, ensuring a smooth transaction.

Common Mistakes to Avoid

When dealing with Costco mortgage closing costs, several common mistakes can lead to unnecessary expenses:

- Not Reviewing the Loan Estimate: Always carefully review your Loan Estimate document to understand all potential fees.

- Overlooking Negotiation Opportunities: Many closing costs are negotiable, especially with the seller.

- Missing Deadlines: Pay attention to important deadlines to avoid late fees or complications.

Avoiding these pitfalls can help you save money and ensure a smoother closing process.

Benefits of Choosing Costco Mortgage

Opting for a Costco mortgage offers several advantages:

Exclusive Member Rates

Costco members typically receive preferential rates and terms not available to the general public.

Streamlined Process

The program's structure simplifies the mortgage application process through dedicated support and clear communication channels.

Trusted Partners

Working with reputable lenders and service providers ensures quality and reliability throughout the transaction.

Frequently Asked Questions

Here are some common questions about Costco mortgage closing costs:

Are Costco Mortgage Rates Better Than Traditional Lenders?

While rates are competitive, it's essential to compare multiple offers to ensure you're getting the best deal.

Can I Use My Own Service Providers?

Yes, while Costco has preferred providers, you're not obligated to use them and can shop around for better rates.

What If I'm Not a Costco Member?

Unfortunately, the mortgage program is exclusively available to Costco members.

Conclusion

Understanding Costco mortgage closing costs is crucial for anyone considering this home financing option. By breaking down these costs and exploring strategies to minimize them, you can make more informed decisions about your home purchase. Remember to carefully review all documents, shop around for services, and take advantage of member benefits to ensure you're getting the best possible deal.

We hope this comprehensive guide has provided valuable insights into Costco mortgage closing costs. If you found this information helpful, please consider sharing it with others who might benefit. Additionally, feel free to leave a comment below with any questions or experiences you'd like to share. For more resources on home buying and mortgage options, explore our other articles and guides.