Voluntary repossession with no late payments is an option that many vehicle owners may not be familiar with, but it can be a strategic move in certain financial situations. When you find yourself unable to meet your car loan obligations, voluntary repossession allows you to return the vehicle to the lender willingly, potentially avoiding some of the negative consequences of involuntary repossession. Even if you have no late payments, this choice might still be worth considering if your financial situation is expected to change.

Repossession, whether voluntary or involuntary, is a serious decision that can impact your credit score and financial future. However, understanding the nuances of voluntary repossession can help you make informed decisions. This guide will delve into the ins and outs of voluntary repossession, especially when you have no late payments, and provide you with actionable steps to navigate this process effectively.

By the end of this article, you'll have a comprehensive understanding of voluntary repossession, its implications, and how to manage it responsibly. Whether you're considering this option or simply want to be informed, this article will equip you with the knowledge you need to make the best financial decisions for your situation.

Read also:Best Securely Connect Remoteiot P2p Ssh Raspberry Pi Free

Table of Contents

- What is Voluntary Repossession?

- Why Choose Voluntary Repossession?

- Voluntary Repossession with No Late Payments

- Steps to Initiate Voluntary Repossession

- Impact on Credit Score

- Alternatives to Voluntary Repossession

- How to Rebuild Credit After Repossession

- Legal Considerations

- Common Misconceptions

- Conclusion

What is Voluntary Repossession?

Voluntary repossession occurs when a borrower willingly returns a financed vehicle to the lender because they can no longer afford the payments. Unlike involuntary repossession, where the lender reclaims the vehicle without the borrower's consent, voluntary repossession allows the borrower to take control of the situation. This option is typically chosen when the borrower anticipates financial difficulties or is already struggling to make payments.

Although voluntary repossession is often associated with missed payments, it can also be a viable option for borrowers with no late payments. For instance, if you foresee a significant change in your financial situation—such as a job loss or medical emergency—you may choose to return the vehicle proactively. This can help you avoid the stress and potential legal complications of involuntary repossession.

Key Differences Between Voluntary and Involuntary Repossession

- Voluntary Repossession: The borrower initiates the process by contacting the lender and arranging to return the vehicle.

- Involuntary Repossession: The lender sends a repossession agent to seize the vehicle without the borrower's consent.

Why Choose Voluntary Repossession?

Choosing voluntary repossession can offer several advantages, especially when compared to involuntary repossession. While it may seem counterintuitive to return a vehicle when you have no late payments, there are scenarios where this decision can be beneficial.

1. Avoiding Legal Hassles

By initiating voluntary repossession, you can avoid the legal complications that often accompany involuntary repossession. Involuntary repossession can involve court proceedings, towing fees, and even legal action against the borrower. Voluntary repossession allows you to maintain a more amicable relationship with the lender.

2. Minimizing Financial Loss

While voluntary repossession will still impact your credit, it may result in fewer fees compared to involuntary repossession. For example, you can avoid towing charges and storage fees that are typically associated with involuntary repossession.

3. Proactive Financial Planning

If you anticipate financial challenges, voluntary repossession allows you to plan ahead. Returning the vehicle before missing payments can demonstrate responsibility to the lender, potentially opening the door for future negotiations.

Read also:Discover The Allure Of Barbienjd A Comprehensive Guide To Style And Influence

Voluntary Repossession with No Late Payments

Voluntary repossession with no late payments might seem unusual, but it can be a strategic decision for borrowers facing financial uncertainty. For example, if you know that your income will decrease significantly in the near future, returning the vehicle now can prevent missed payments and further damage to your credit.

Steps to Consider

- Assess your financial situation and determine if returning the vehicle is the best option.

- Contact your lender to discuss voluntary repossession and understand their policies.

- Review your loan agreement to understand any potential penalties or fees.

Steps to Initiate Voluntary Repossession

Initiating voluntary repossession involves several key steps to ensure a smooth process. Follow these guidelines to navigate the process effectively:

1. Contact Your Lender

Reach out to your lender as soon as possible to discuss your situation. Explain your financial challenges and express your intention to return the vehicle voluntarily. Many lenders are willing to work with borrowers who take proactive steps.

2. Review Loan Terms

Before proceeding, review your loan agreement to understand the terms related to repossession. Pay attention to any fees, penalties, or obligations you may have after returning the vehicle.

3. Schedule the Return

Work with your lender to schedule a convenient time and location to return the vehicle. Ensure that the vehicle is in good condition and that you have all necessary documents, such as the title and keys.

Impact on Credit Score

Voluntary repossession, even with no late payments, will negatively impact your credit score. However, the extent of the damage depends on how the repossession is reported to credit bureaus. Typically, voluntary repossession is reported as a "charge-off" or "repossession," both of which can lower your credit score significantly.

How Long Does It Stay on Your Credit Report?

A voluntary repossession can remain on your credit report for up to seven years. During this time, it may affect your ability to secure new loans or credit cards. However, taking steps to rebuild your credit can mitigate some of the long-term effects.

Alternatives to Voluntary Repossession

If you're considering voluntary repossession, it's worth exploring alternative options that might help you keep your vehicle and avoid credit damage.

1. Loan Modification

Some lenders offer loan modification programs that can lower your monthly payments or extend the loan term. This can make your payments more manageable and help you avoid repossession.

2. Refinancing

Refinancing your auto loan with a new lender can reduce your monthly payments and provide financial relief. However, this option requires good credit and sufficient income.

3. Selling the Vehicle

If you have equity in the vehicle, selling it privately might be a better option than repossession. This allows you to pay off the loan and potentially keep some of the proceeds.

How to Rebuild Credit After Repossession

Rebuilding your credit after voluntary repossession requires time and effort. Here are some strategies to help you recover:

1. Pay Bills on Time

Consistently paying your bills on time is one of the most effective ways to rebuild credit. This demonstrates financial responsibility and helps improve your credit score over time.

2. Use Secured Credit Cards

Secured credit cards are designed for individuals with poor or limited credit. By using a secured card responsibly, you can establish a positive payment history and improve your credit score.

3. Monitor Your Credit Report

Regularly review your credit report to ensure that all information is accurate. Dispute any errors or inaccuracies that could further harm your credit score.

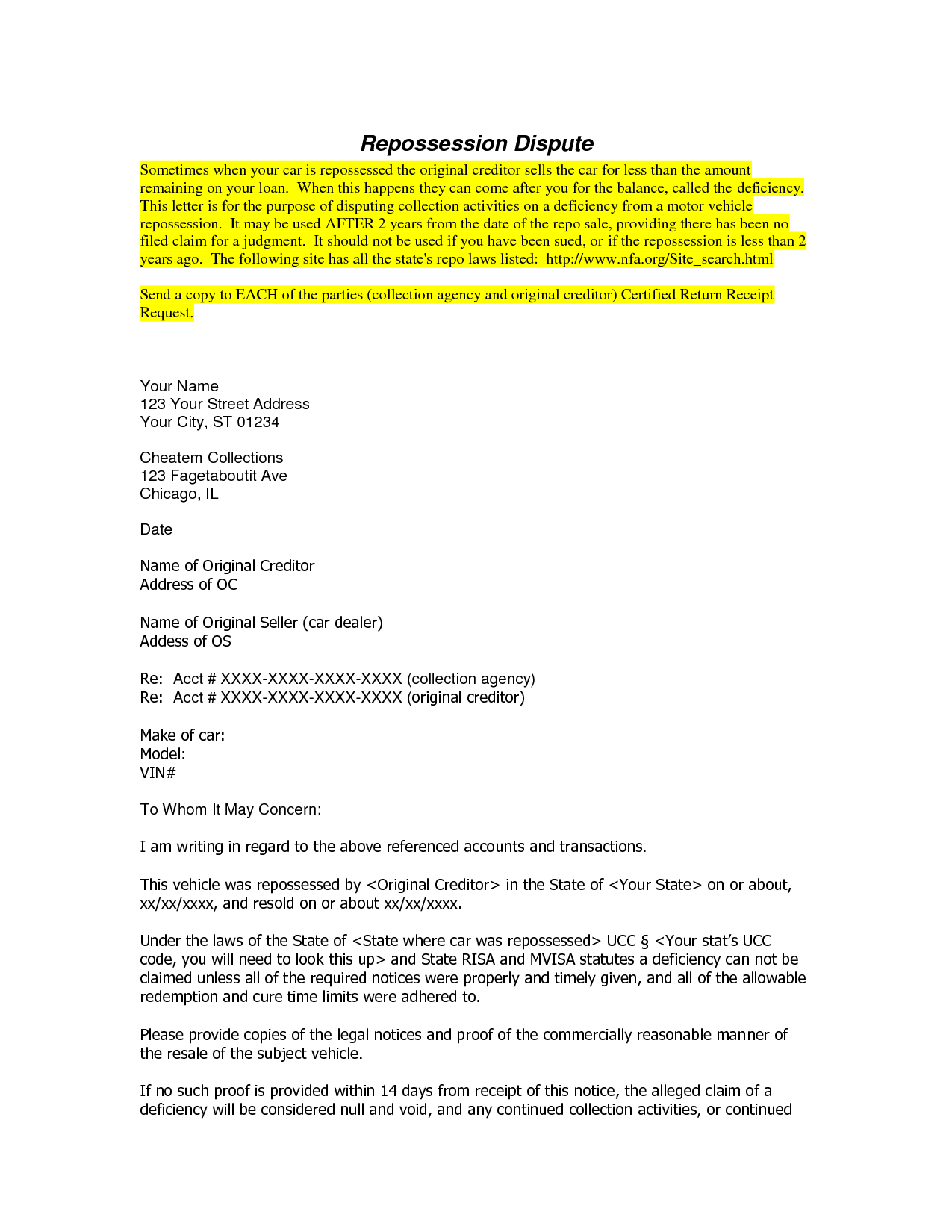

Legal Considerations

Voluntary repossession involves several legal considerations that borrowers should be aware of. Understanding these factors can help you avoid potential pitfalls.

1. Deficiency Balance

After repossession, the lender may sell the vehicle to recover the outstanding loan balance. If the sale proceeds do not cover the remaining balance, you may be responsible for the deficiency. This amount can be substantial, so it's important to understand your obligations.

2. State Laws

Repossession laws vary by state, so it's essential to familiarize yourself with the regulations in your area. Some states have specific protections for borrowers, while others allow lenders more flexibility.

Common Misconceptions

There are several misconceptions about voluntary repossession that can lead to confusion. Here are a few common myths and the truth behind them:

1. "Voluntary Repossession Won't Affect My Credit"

While voluntary repossession may have a slightly less severe impact than involuntary repossession, it will still harm your credit score. Both types of repossession are reported to credit bureaus and can stay on your credit report for up to seven years.

2. "I Can Return the Vehicle Without Paying Anything"

Returning the vehicle does not absolve you of your financial obligations. You may still be responsible for the remaining loan balance, as well as any fees or penalties associated with repossession.

Conclusion

Voluntary repossession with no late payments is a complex but potentially beneficial option for borrowers facing financial challenges. By taking proactive steps, you can minimize the negative impact on your credit and avoid the legal complications of involuntary repossession. However, it's crucial to weigh the pros and cons carefully and explore all available alternatives before making a decision.

If you're considering voluntary repossession, we encourage you to reach out to your lender and discuss your options. Additionally, take steps to rebuild your credit and improve your financial health after the process. Share your thoughts or experiences in the comments below, and don't hesitate to explore other articles on our site for more financial guidance.